Farm & Ranch Real Estate Loans Nationwide

Farm and ranch real estate loans, operating lines of credit, and agricultural financing solutions are at the heart of Conterra. We provide customized lending options to help farmers, ranchers, and rural landowners purchase land, expand operations, or refinance existing debt—no matter where they farm in the United States.

Our regional relationship managers, located across the country, work directly with producers to deliver flexible and creative financing that supports long-term success. Whether you need a traditional real estate loan, short-term operating capital, or a transitional lending option, our goal is to help your operation thrive through every agriculture cycle.

Conterra Ag Capital is proud to support American agriculture with diverse financial products and deep industry expertise. We are a lender with perspective, focused entirely on agriculture and committed to helping rural America grow.

Conterra offers a wide range of farm and ranch loan products designed to meet the needs of today’s farmers, ranchers and agribusiness professionals.

Conterra understands that not all borrowers look the same. We offer alternative ag lending solutions for farmers and ranchers who do not meet traditional financing standards.

We offer farm development loans for producers looking to expand their current operation or looking to diversify production.

The Conterra Operating Loan Program is designed to provide Operating Lines of Credit (LOCs) to farmers who farm federally insured crops.

Conterra provides loans to agribusiness facilities and leases on new or pre-owned production equipment. Loans can assist with new construction or improvements on existing facilities.

A Revolving Line of Credit (RLOC) allows borrowers to take advantage of lower interest rates as long-term fixed rates continue to rise. Funds from this real estate secured, short-term variable rate product can be utilized however you choose.

Find an ag lender in your area

“Agriculture is our wisest pursuit, because it will in the end contribute most to real wealth, good morals and happiness”

Apply Now: Get A Fast Approval

We have a many loan products including our Rapid Application which is a credit scorecard based model designed to deliver quick underwriting decisions with a simplified application process.

I think Conterra understands agriculture better than anyone I have ever dealt with. Most lending institutions are all finance, but Conterra came and looked at the operation and saw we were doing the best we could under the circumstances."

How Lenders Actually Value Ag Real Estate (It’s Not Just the Appraisal)

When it comes to ag real estate, the appraisal gives you a value, but it doesn’t tell you what the lender will offer.

Land can appraise high and still not support the loan you expected. Not because something’s wrong, but because lenders aren’t just pricing dirt. We’re pricing for repayment and risk.

When Refinancing a Farm Loan Makes Sense—and When It Doesn’t

A practical look at timing, structure, and long-term fit for farm loans Refinancing a farm real estate loan isn’t something most producers set out to

Why Strong Ag Land Deals Start with Lender Conversations

In agricultural real estate, some of the biggest problems don’t show up on a price sheet. They surface late in the process when financing questions

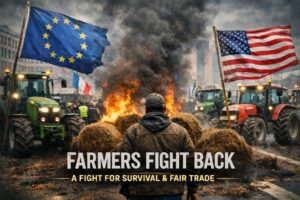

The Farmer Revolt in Europe, A Fight for Survival.

The biggest story you probably haven’t heard about on your mainstream news station. The American media largely ignores the farmer protests happening across the EU.

2026 Ag Outlook: Land, Lending, and the New Crop Cycle

Full Bins, Flat Prices: Margin Pressure Builds Despite Corn Record Corn, Wheat, and Soybeans in the Bins The 2026 ag outlook signals a correction, not

Farm Programs Go Quiet as Washington Stalls

Congress didn’t pass a budget by the October 1 deadline, and that’s sent the federal government into shutdown. For agriculture, this is more than just